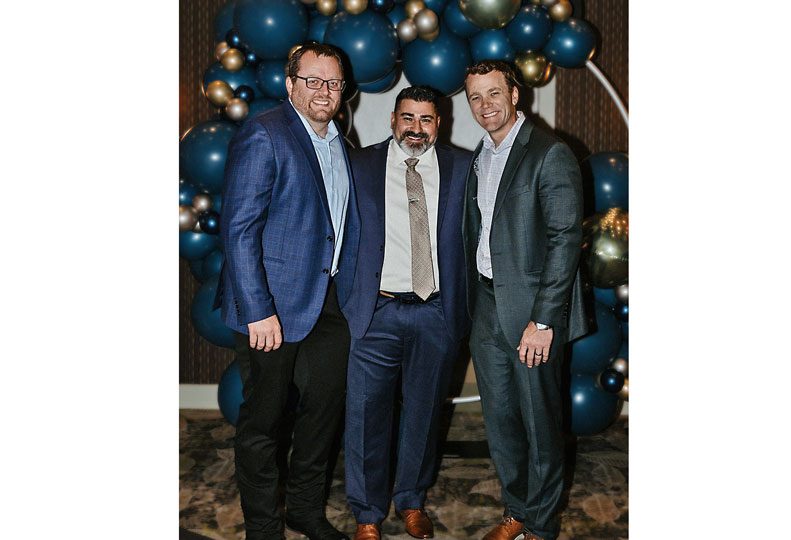

L2 Wealth Management partners, from left, Doug Lupton, Mario Martinez, and Mark Lupton pool their talents to provide a holistic approach to retirement planning investments.

| L2 Wealth ManagementL2 Wealth Management is founded on teamwork

Private client group focuses on retirement planning investments

Despite its investment-first focus, L2 Wealth Management, a young offshoot of Northwestern Mutual-Inland Northwest, harkens to its insurance company roots for its team approach to serving clients, says L2 co-founder Doug Lupton.

Prior to forming L2, Lupton began working for Northwestern Mutual in 2016, joining his brother Mark, who had been with Northwestern Mutual since 2002.

“From day one, I was working with my brother,” he says.

They formalized their L2 partnership in 2021.

Although their now-retired father Kent Lupton started the Northwestern Mutual-Inland Northwest general agency here in 1974, L2 isn’t their father’s life insurance company.

“We are much more heavily into retirement planning investments, estate planning, and taxation than just traditional Northwestern Mutual life insurance, disability, and long-term care,” Lupton says. “We probably do 80% of our work on the investment side and probably 20% of our work on the insurance side.”

Lupton says some plans include annuities when appropriate. “I like to tell people that I don't think more insurance is the answer to every single question in the world out there,” Lupton says.

L2’s Spokane Valley office is located in leased space at the Northwestern Mutual building at 12939 E. Pinecroft Way.

It also has an office in Kennewick, where L2 partner Mario Martinez is based, and a presence in Wenatchee, Washington.

Its geographical footprint includes communities throughout Eastern Washington and northern Idaho, although L2 has clients in almost 40 states, Martinez says.

“For us, it’s really important that our teams represent communities we live in, and our team right now has five people who speak Spanish and can serve that sector or our community,” he says. “The last thing we want is for anyone in our community feeling like they don’t have a place when it comes to their financial planning.”

As a private client investment group of Northwestern Mutual, L2 can access Northwestern Mutual products, Lupton says.

“But we’re not a captive agent of Northwestern Mutual,” he says, meaning L2 can sell products from other insurance companies.”

“The same thing is true for the investment side,” Lupton says. “We don’t have Northwestern Mutual stock funds or real estate funds. We use Fidelity, or Putnam, or BlackRock (investment companies).”

While the L2 name originally referred to the second Lupton generation, that meaning has less significance now that the team has grown to 19 employees in three locations.

Martinez, who focuses on families and small businesses, joined L2 as its third partner in 2022 after working for Northwestern Mutual there since 2013.

Martinez came to Northwestern Mutual with a background in law enforcement.

“I had a little bit of a different path to this career,” he says. “Planning and helping people understand their finances better was definitely something that was always part of my makeup.”

Martinez says many skills gained in his previous career have transitioned well to wealth management.

Lupton says his focus is on families with an emphasis on preretirees and retirees.

“The 55-plus space is where I really enjoy working because of the different complexities of the planning and the income-distribution side of it and taxation and all those things that feed into it,” he says.

He grew up in Spokane, went to Whitworth University, married his high school sweetheart, and worked in corporate finance in Tacoma for 10 years before returning to Spokane and joining Northwestern Mutual.

Mark Lupton, who specializes in estate planning and works with business owners and high-net worth clients, started his career in financial services as an accountant and was a CPA for two years before deciding he didn’t want to do tax returns and audits for the rest of his life, his brother explains.

“He’s still a licensed CPA and still keeps his accreditations, and that’s one of our biggest differentiations is the value that our firm brings on the tax-planning side,” Lupton says.

Martinez adds, “(Mark Lupton) spends quite a bit of time making sure that that wealth transfers happening from generation to generation are done well.”

L2 recently promoted Josh Lane to wealth management adviser. Lane, who started with L2 in 2022 as a planning assistant, will specialize in retirement distribution, small business planning, tax mitigation, and life insurance.

Together, L2 advisers combine their individual specialties to serve clients better, Martinez says. “We decided to pool our resources rather than every person on our team having to be the best at everything at all times for every client.”

The team approach keeps members updated on clients to ensure seamless transitions if the client’s situation and stage of life falls within the specialties of another team member, a concept that Kent Lupton pioneered 50 years ago.

Martinez says L2 has made it part of its mission to ensure that as advisers stage through their career on the team, they have other people who are prepared to make sure that clients aren’t left alone.

“One of the things we learned from Kent and some of the other mentors we have is that one of the toughest things you can do as you near retirement is to have to start looking for another financial adviser,” he says.

Lupton says L2’s approach to planning with clients goes beyond immediate investments and returns.

“We need to make sure that everything’s OK even when bad things happen,” he says.

Similarly, Martinez says that L2 focuses on clients as people as opposed to investment accounts and insurance policy numbers.

“We work extremely hard to make sure that people know that this business is a safe place for them to come and have real conversations,” he says.

L2 charges clients primarily through a percentage of assets managed for investments, commissions for insurance products, and flat fees for one-time services.

“Most of our ongoing relationships are percentage of assets and/or insurance,” Lupton says.

L2 currently has about $670 million in assets under management.

“We have quite a bit of cash value and insurance policies with clients as well,” he says.

Lupton says 80% to 90% of new clients connect with L2 through referrals from existing clients.