Home » Freight volumes by planes, trains, trucks all drop steeply

Freight volumes by planes, trains, trucks all drop steeply

Outlook in INW remains positive for rest of 2020, though, observers say

August 13, 2020

Use of the biggest freight transportations modes in the Inland Northwest all declined sharply in usage at the start of the COVID-19 pandemic but are slowly starting to climb back to normal levels, industry representatives say.

Spokane boasts all three of the top domestic transportation modes in the nation, with truck, rail, and air freight shipping capabilities available to companies.

Jeff Bosma, co-owner of Spokane-based Fast Way Freight System Inc., says trucking freight volumes dropped 25% in April, compared with average volumes for that month in recent years.

Typically, he says, April is the start of the trucking industry’s busy season. This year, it was the slowest month for all trucking companies, he says.

“That was when there were most of the unknowns, and a lot of companies closed,” says Bosma, a member of the Washington Trucking Association.

The industry slowly recovered following that dip and now is back to what Bosma says are “typical summer levels.”

The trucking industry’s busy season is generally early summer through October, he adds, with slowdowns following the harvest season for agriculture products, and then further decreases during the holiday season when winter weather starts.

Bosma estimates several trucking companies are about 60 days behind schedule and are scrambling to catch up as high-demand industries reopen.

In Fast Way Freight’s case, construction and agriculture are showing the biggest demand as contractors resume projects that stopped in April when the state-ordered shutdown mandate went into effect.

Agriculture makes up about 20% of Fast Way’s customer base. The industry’s shipping volumes are currently on par with what the company saw in previous years, he adds, following the large dip in April as growers head into the harvest season.

He estimates Fast Way Freight handles between 400 and 500 freight bills a day. A single trailer could have upwards of 20 different shipments, he explains, and one freight bill refers to a single shipment within that trailer.

About 90% of the company’s shipments occur within 200 miles of the company’s locations. Fast Way is headquartered at 1001 N. Havana, and has locations in Lewiston, Idaho, and Wenatchee as well. Fast Way Freight has a fleet of about 60 trucks and 57 drivers, he says.

Bosma says the biggest challenge he sees for the industry now is protecting employees and customers from coronavirus.

Fast Way has implemented cleaning procedures and has limited interactions between drivers, office workers, and shop personnel, along with requiring employees to wear personal protection equipment, he says.

In the area of sales, Bosma says Class 8 truck and trailer sales dropped 62.5% in May compared to last year. Year to date, sales of Class 8 trucks are down 37.7% compared to last year.

A Class 8 truck is a truck that weighs 33,000 pounds or more and used for the transportation of bigger loads for longer distances, such as a semi-truck.

Bosma speculates fleets aren’t upgrading due to the presence of the virus and 2020 being an election year.

“We’re not buying any equipment at the moment either,” he adds.

Despite that, Bosma says he’s expecting to end 2020 on par with 2019’s revenue levels. He declines to disclose the company’s annual revenue.

Washington state Department of Transportation data shows truck freight volume was down in all eight of the counties it currently tracks as of July 31.

Data was not provided for Spokane County.

Snohomish County saw the biggest decrease at 24% compared to the year prior, followed by King County, down 15% and Clark County, down 11%.

Nationwide, the American Trucking Association reports its seasonally adjusted for-hire truck tonnage index increased 8.7% in June after falling 1% in May. Compared to June 2019, the index was down 1.3%, the third year-over-year decline, according to a press release from the association. Year-to-date, tonnage is down 2.4% compared to the same period a year prior.

In total, trucks carried 11.84 billion tons of freight in 2019.

An Americas Commercial Transportation Research Co. LLC freight forecast in late March projected truckload tonnage will be down 5% through 2020, with economic stabilization occurring in the third quarter of the year and recovery the following quarter. It also estimated that less-than-truckload tonnage in 2020 would be down 9% by year’s end.

The trucking industry represents 72.5% of tonnage carried by all modes of domestic freight transportation, according to the American Trucking Association.

In the area of railway freight, Fort Worth, Texas-based BNSF Railway Company saw volumes decline through the first quarter of the year, says Courtney Wallace, Seattle-based director of external communications for the company.

“We move a very wide variety of products, which makes our volume trends helpful to look at and see what has been going on in the economy,” says Wallace in an email to the Journal.

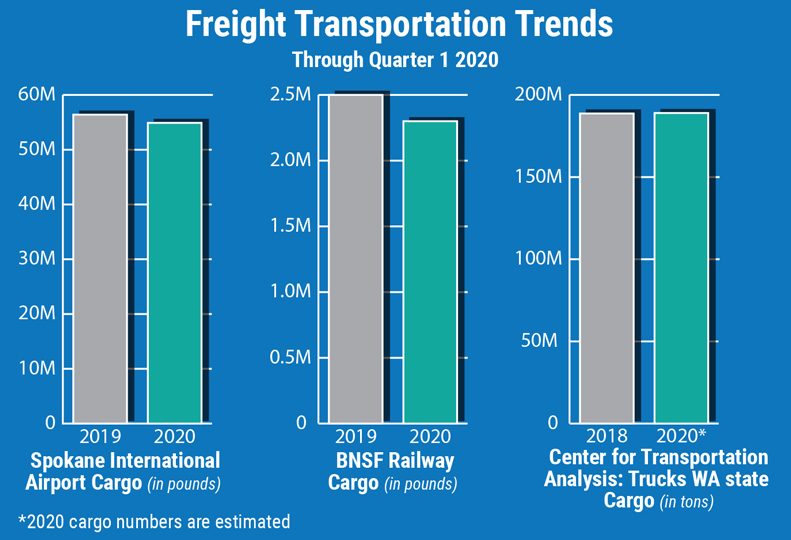

Freight volumes at BNSF were down 5% through the first quarter of 2020 compared to the year prior, with large declines occurring through March, Wallace says.

“(It) leveled out about 25% below what we were expecting through April and May,” she adds, “and we are down near similar volumes to what we saw during the Great Recession in 2009.”

In total, she says, volumes are down 12% through the end of May.

“We believe we’ve seen the bottom and anticipate seeing a slow, gradual increase in volumes from June through the end of the year,” Wallace says.

Spokane averages between 50 to 60 trains a day, she adds, which includes Amtrak.

At Spokane International Airport, enplaned cargo poundage, or cargo being shipped out, decreased 8.3% year-to-date through May compared to the year prior. In total, nearly 21.4 million pounds of cargo has been shipped through May, down from 23.3 million pounds through May 2019, say airport records.

Todd Woodard, director of marketing and public affairs for the airport, says via email that “air cargo business is very proprietary in terms of the commodities and products that are being shipped,” and therefore was unable to provide a broader breakdown of shipping volumes.

Deplaned cargo, or cargo being shipped in, was up 1.36% through May, according to the data, which translates to roughly 33.5 million pounds of incoming cargo, up from 33.1 million pounds during the same period last year.

Overall, cargo poundage was down 2.64% year-to-date in May, compared to the same period last year.

Latest News Up Close

Related Articles

Related Products